Importing from a third party piece of software

This assumes you have already set up the client in Sage Business Tax.

- Export the data from your accounts production software. Do this from within the accounts production application you are using.

- Log in to Sage Business Tax. The Client List window appears.

- Select the client to import the accounts data into.

- Click Select. Your client opens.

-

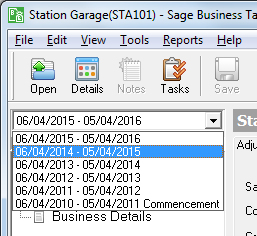

Choose the correct Accounting Period to import the data to. Show me.

- Open the Business and Investment Income section of the tax return.

-

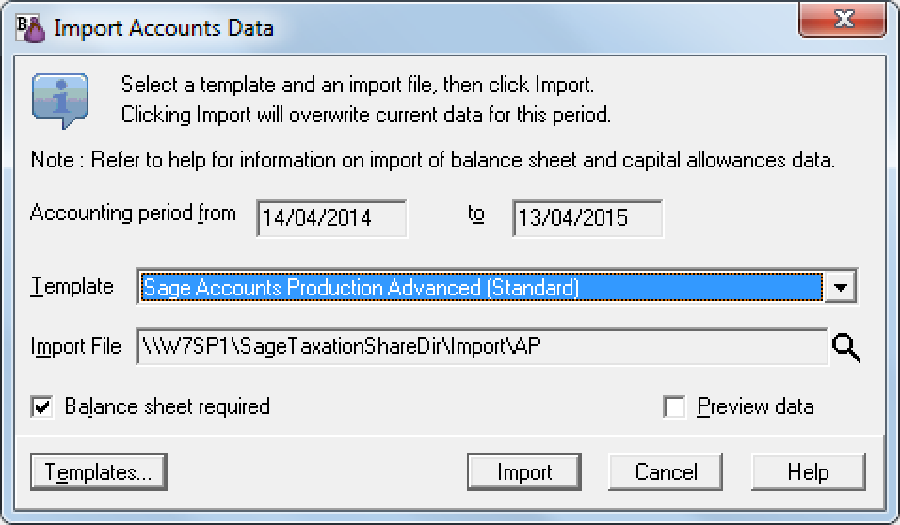

From the Tools menu, choose Import Accounts Data. The Import Accounts Data window appears. Show me

- Choose the template you're going to use for the import from the Template drop-down list.

- Click the magnifying glass icon to the right of the Import File box. An open file window appears.

- Use the window to find the file you exported from Sage APA and select it in the window.

- Click Open. The filename and path will be shown in the Import File box.

- Click Import to import the data. You will see the imported data on page 4 of the Partnership Tax Return.

Note: The Accounts Import will always import accounts data for the currently selected accounting period (even if the accounting period you exported was a different one). Also note that only standard accounts data is transferred, capital allowances and overlap profits are not.